Learn about USDC

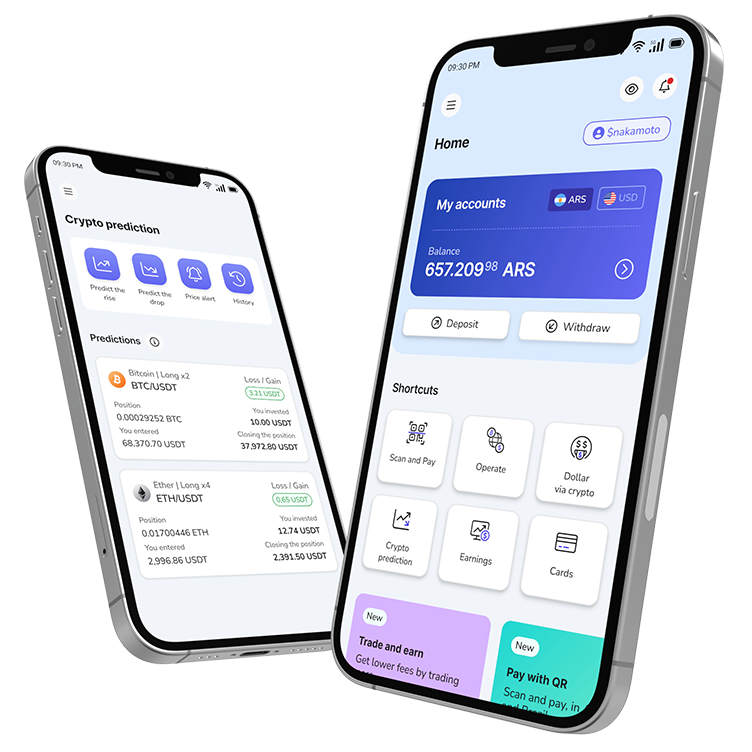

Check the price of USDC in us dollar in the simplest way with Satoshi Tango

USDC: what is it and what is the price of this stablecoin

USDC is the name of one of the most well-known, accepted and used stablecoins in the crypto ecosystem. Like all other stablecoins, its value is stable and pegged to some other asset, in this case the value of the US dollar. We invite you to learn everything about this stable cryptocurrency so that you can invest in it.

What is the price of the USD Coin?

The price of USDC is linked to the price of the US dollar on a 1:1 basis, meaning that each USDC is equal to one dollar. We invite you to see our graphs to know its price.

USD Coin to us dollar

Know the value of USDC in pesos in real time using our graph.

USD Coin to Dollar

As we mentioned earlier, the value of one USDC is equal to the value of one US dollar. The graph of stablecoins is particular and different from that of other cryptocurrencies. We invite you to know the price of this crypto dollar.

What is USD Coin (USDC)?

USDC is one of the largest stablecoins in the crypto world. Being a stablecoin, as its name suggests, its value remains stable and is pegged at a 1 to 1 ratio with the US dollar. This means that each unit of USDC is equivalent to 1 dollar.

Circle and Coinbase jointly formed the company Center, which is responsible for controlling the issuance. It is an ERC-20 token that operates through a smart contract on the Ethereum network.

History of the USDC stablecoin

USDC was born on September 26, 2018, when the smart contract was created and began operating. The idea behind creating this stablecoin was to compete with USDT, launched in 2014 and widely accepted in the ecosystem, but with some drawbacks such as its high cost to move and its inability to be used on decentralized exchanges due to the network it operates on. That is why Circle and Coinbase joined forces to create this stable cryptocurrency on the Ethereum blockchain, which would allow it to be moved more efficiently and make it very easy to integrate it into decentralized projects.

Features of USD Coin

- It is stable: its value is maintained at 1 to 1 with the dollar

- It is an ERC-20 token: it operates on the Ethereum blockchain

- Integrable: it can be used in decentralized applications and decentralized exchanges

How does USDC crypto work?

To issue new tokens, a deposit must be made into Centre’s accounts, similar to USDT and Tether. Once Centre receives that deposit, the smart contract it operates with creates the same amount of USDC and deposits it into an Ethereum address, where the buyer can store and use them to buy, sell, or protect their savings. A similar process occurs for token withdrawals: when withdrawing USDC and sending them to a bank to withdraw dollars, those USDC are removed from Centre’s accounts and burned. This ensures a balance between US dollars in bank accounts and USDC on the blockchain.

Advantages and disadvantages of the virtual currency USD Coin

Stablecoins are a particular type of cryptocurrency that have many advantages, although like everything, they also have certain disadvantages worth mentioning. Let’s see what they are in the case of USDC.

Advantages of the USDC currency

- USDC vs DAI: there is no commission to buy USDC, while there is a commission to buy DAI

- Exchangeable: USDC can be exchanged for any other cryptocurrency

- Utility: it allows for quick sending and receiving of dollars

- Reliable: it has a strong security history

Disadvantages of USDC

- USDT or USDC: both are, in one way or another, centralized models

- Freezing: Circle can freeze funds under its own criteria

- Official policies: Circle is registered as a money transmitter, so it is subject to official monetary policies

- Delay: transactions with USDC tend to take a bit longer

USDC Argentina - Frequently Asked Questions

What does USDC mean?

The initials USDC refer to United States Dollar Coin. It is a stable cryptocurrency whose value is tied to the US dollar at a 1 to 1 ratio.

What is the difference between USDT and USDC?

USDC is backed by cash in a transparent manner, while there are still some doubts about how USDT is backed.

Which is safer, USDT or USDC?

Although both are secure, it is worth mentioning that there are some doubts about the backing of USDT, doubts that do not exist about the backing of USDC as it is completely transparent.

Generate profits with your cryptos

Grow your investments faster with Satoshi Tango. We offer the best rates on the market and best of all, profits are credited daily in the same currency you invested in.